Business

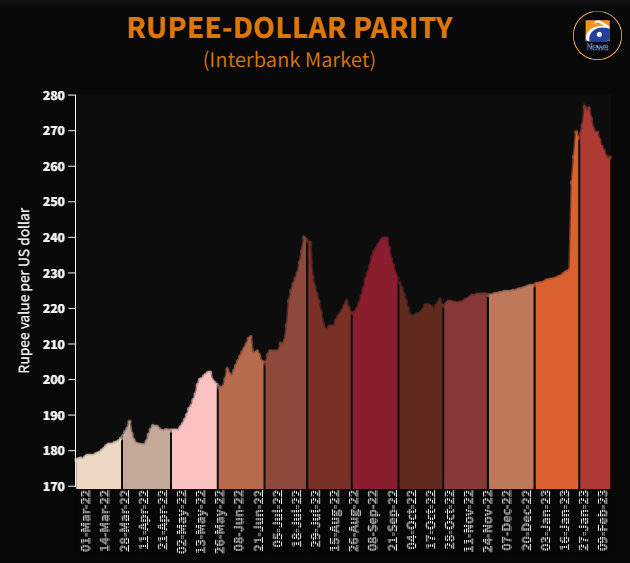

Rupee snaps 5-day long winning streak

-

Latest News8 hours ago

Latest News8 hours agoPakistani Internet: Everything you should know about “Africa-2” contemporary cables

-

Latest News8 hours ago

Latest News8 hours agoThe PPP and PML-N will confer on power-sharing arrangements in Punjab today.

-

Entertainment8 hours ago

Entertainment8 hours agoHania Aamir reveals details about her troubled childhood.

-

Business8 hours ago

Business8 hours agoWith its second-largest surge ever, PSX approaches 114,000 points.

-

Latest News8 hours ago

Latest News8 hours agoWapda announces a revised timeline for the K-4 water project in Karachi.

-

Latest News4 hours ago

Latest News4 hours agoA Seminar on Deciphering the Influence of the Media Is Being Organized by IICR

-

Latest News4 hours ago

Latest News4 hours agoClimate-related challenges are growing in Pakistan, and the prime minister’s climate aide is advocating for gender-inclusive climate resilience.

-

Latest News4 hours ago

Latest News4 hours agoAs of today, the F-8 Underpass is now open to traffic. Naqvi