Business

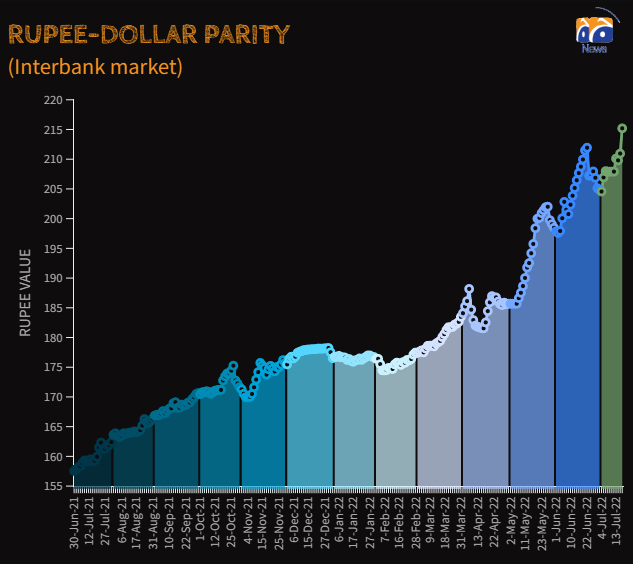

‘Political uncertainty’: Pakistani rupee hits new low of 215.20 against US dollar

-

Latest News2 days ago

Latest News2 days agoPakistani Internet: Everything you should know about “Africa-2” contemporary cables

-

Latest News2 days ago

Latest News2 days agoAn NIH case of wild poliovirus was discovered in Balochistan, marking the 65th confirmed case of polio.

-

Latest News2 days ago

Latest News2 days agoClimate-related challenges are growing in Pakistan, and the prime minister’s climate aide is advocating for gender-inclusive climate resilience.

-

Entertainment2 days ago

Entertainment2 days agoHania Aamir reveals details about her troubled childhood.

-

Latest News2 days ago

Latest News2 days agoThe PPP and PML-N will confer on power-sharing arrangements in Punjab today.

-

Business2 days ago

Business2 days agoWith its second-largest surge ever, PSX approaches 114,000 points.

-

Latest News2 days ago

Latest News2 days agoAn event for medical training is being held at CMH Peshawar, and Major General Masood is distributing awards.

-

Latest News2 days ago

Latest News2 days agoGovernment-Opposition Discussions: Prime Minister Optimistic Regarding Favorable Resolution of Dialogue