Business

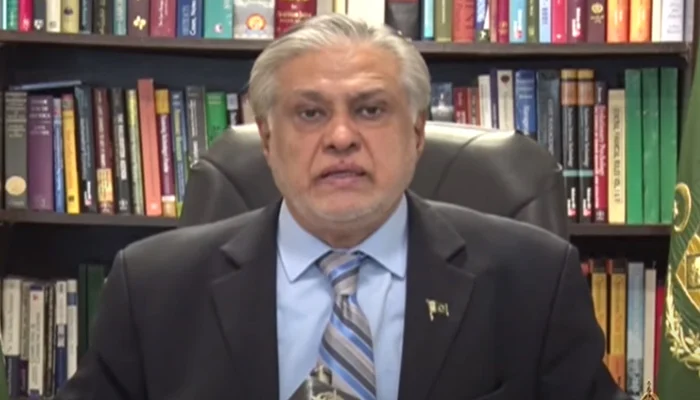

IMF deposits $1.2 billion into SBP’s account: Ishaq Dar

-

Latest News3 days ago

Latest News3 days agoPIA-Mora Agreement Regarding Hajj Flights: PIA Will Offer Travel Services to 35,000 Hajj Pilgrims Under Government Program

-

Business3 days ago

Business3 days agoPIA Privatization Is Referred to the Cabinet Committee by the Privatization Commission Board Meeting

-

Latest News2 days ago

Latest News2 days agoUnlawful VPNs: Terrorists Utilize Unregistered VPNs to Disseminate Propaganda

-

Business3 days ago

Business3 days agoPetrol prices are expected to experience another increase in Pakistan.

-

Latest News3 days ago

Latest News3 days agoDeputy Prime Minister Speaks at COP-29 Summit: Pakistan Needs $348 Billion to Become Climate Resilient by 2030

-

Entertainment3 days ago

Entertainment3 days agoAamir Khan declared his retirement from the film industry.

-

Latest News3 days ago

Latest News3 days agoPCB questions ICC on India’s reluctance to participate in the Champions Trophy in Pakistan.

-

Latest News3 days ago

Latest News3 days agoAhsan says all available resources should be used to eradicate smog at the air pollution meeting.