Business

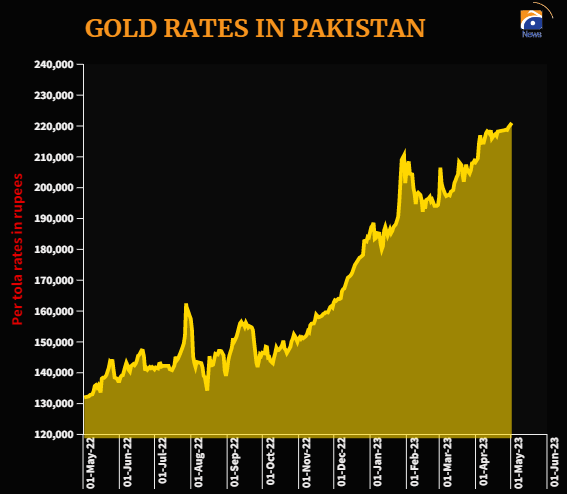

Gold shines bright as it climbs to yet another high

-

Latest News17 hours ago

Latest News17 hours agoPakistani Internet: Everything you should know about “Africa-2” contemporary cables

-

Entertainment17 hours ago

Entertainment17 hours agoHania Aamir reveals details about her troubled childhood.

-

Business17 hours ago

Business17 hours agoWith its second-largest surge ever, PSX approaches 114,000 points.

-

Latest News17 hours ago

Latest News17 hours agoThe PPP and PML-N will confer on power-sharing arrangements in Punjab today.

-

Latest News17 hours ago

Latest News17 hours agoWapda announces a revised timeline for the K-4 water project in Karachi.

-

Latest News12 hours ago

Latest News12 hours agoAn NIH case of wild poliovirus was discovered in Balochistan, marking the 65th confirmed case of polio.

-

Latest News12 hours ago

Latest News12 hours agoClimate-related challenges are growing in Pakistan, and the prime minister’s climate aide is advocating for gender-inclusive climate resilience.

-

Latest News12 hours ago

Latest News12 hours agoA Seminar on Deciphering the Influence of the Media Is Being Organized by IICR