Business

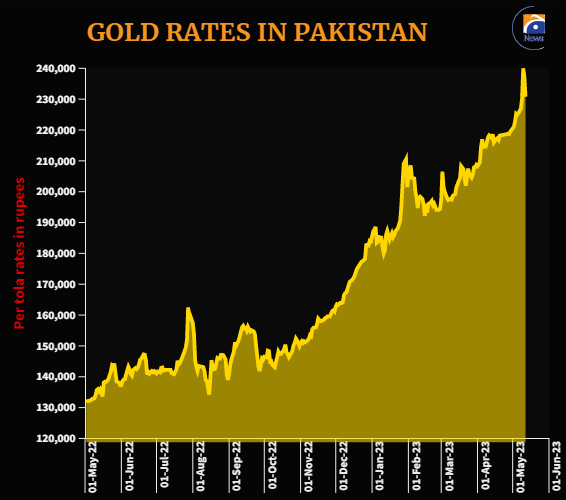

Gold loses shine as price falls for second consecutive day

-

Latest News1 day ago

Latest News1 day agoPakistan Establishes 20 New Trade Posts in China to Increase Investment and Exports

-

Business2 days ago

Business2 days agoIrfan Siddiqui meets with the PM and informs him about the Senate performance of the parliamentary party.

-

Latest News1 day ago

Latest News1 day agoIranian President Offers Condolences for Kurram Terrorist Attack

-

Business2 days ago

Business2 days agoSIFC Increases Direct Foreign Investment: Investment in the Energy Sector Rises by 120%

-

Latest News2 days ago

Latest News2 days agoBilateral Ties Between Pakistan and Belarus: President Lukashenko Will Visit Pakistan November 25–27

-

Latest News1 day ago

Latest News1 day agoPresident and PM Applaud Security Forces for Bannu, Balochistan IBOs in the War Against Terror

-

Latest News2 days ago

Latest News2 days agoSpeaking to a press conference, Marriyum Aurangzeb says the PML-N government has restored the trust of investors.

-

Latest News2 days ago

Latest News2 days agoReaction to the PTI protest call by Fazlur Rehman