Business

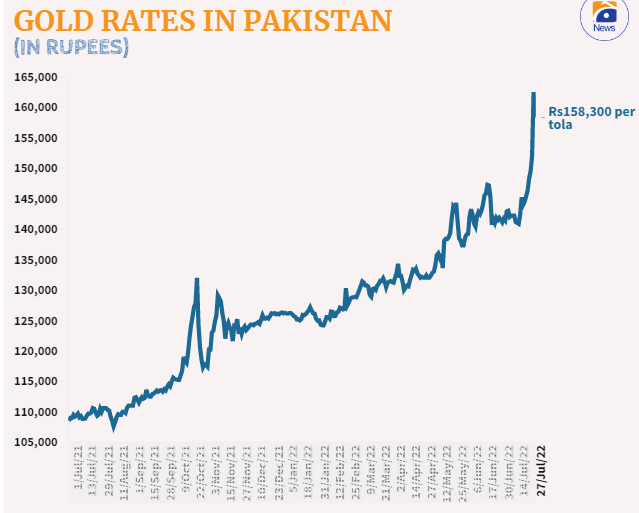

Gold loses shine, price plunges by Rs4,200 per tola

-

Latest News2 days ago

Latest News2 days agoTwelve security personnel were killed in the attack on the Bannu checkpoint.

-

Latest News2 days ago

Latest News2 days agoPakistan and Saudi Arabia have reached an agreement to implement a prisoner exchange arrangement.

-

Latest News2 days ago

Latest News2 days agoThe Supreme Court rejects SIC’s request to be recognized as a parliamentary party.

-

Latest News2 days ago

Latest News2 days agoSix militants were killed and twelve Army personnel were slain in the Khawarij attack on the Bannu checkpost.

-

Latest News2 days ago

Latest News2 days agoBitcoin makes its first breach of $94,000.

-

Uncategorized2 days ago

Uncategorized2 days agoPakistan will begin a full-scale military campaign in Balochistan to combat terrorism.

-

Business2 days ago

Business2 days agoThe price of flour in Islamabad, Punjab, has increased by Rs 1,300.

-

Latest News2 days ago

Latest News2 days agoPTI representatives conjecture in the media over Imran’s approval of bail: FIA investigator