Business

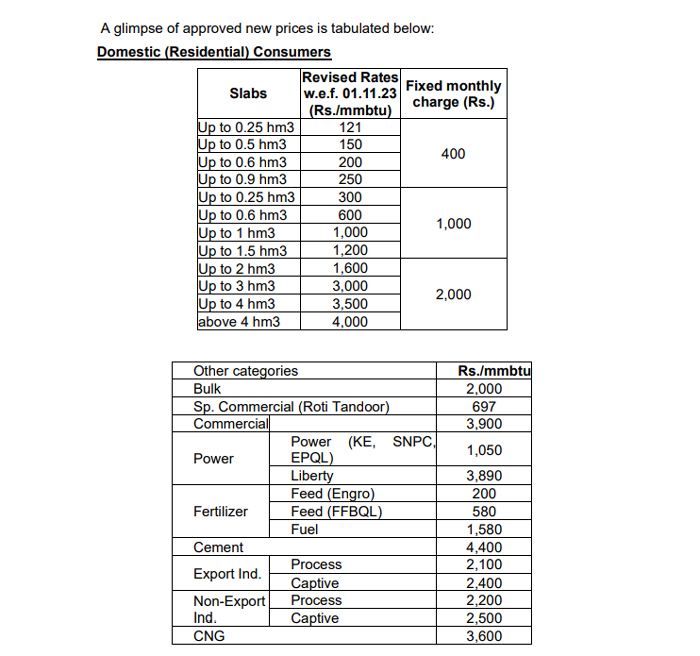

‘Gas bomb’ dropped on masses as govt approves massive price hike

-

Latest News2 days ago

Latest News2 days agoSmog crisis: Punjab will go into complete lockdown, school holidays will be extended

-

Latest News2 days ago

Latest News2 days agoTo combat terrorism, specific actions are required: Mohsin Naqvi

-

Latest News2 days ago

Latest News2 days agoThree Terrorists Are Killed by Security Forces in Harnai District: ISPR

-

Latest News2 days ago

Latest News2 days agoFertilizer Inventory: Rana Tanveer Expresses Contentment Regarding Stock Availability

-

Latest News2 days ago

Latest News2 days agoOver Pakistan, Rain and Snowfall Are Expected Over the Next Three Days

-

Business2 days ago

Business2 days agoDar chairs the CCOP meeting; Blue World’s bid offer of Rs.10 billion is rejected.

-

Latest News2 days ago

Latest News2 days agoPakistan declares AI chatbots to be dangers to security.

-

Latest News2 days ago

Latest News2 days agoIndia’s decision not to play in Pakistan for the Champions Trophy has ICC “seeks” an explanation.